How to Use Net Promoter Score to Get Customer Feedback About Your Furniture Business

- Posted on

- by Jack Young

Table of Contents

Key Takeaways – Net Promoter Score for Feedback

- The Power of Customer Feedback: Understanding how customers perceive your business is essential for building loyalty and driving revenue.

- The Importance of Net Promoter Score (NPS): NPS is a simple yet powerful tool for measuring customer loyalty. By asking customers how likely they are to recommend your business, you can identify promoters, passives, and detractors.

- The “Why” Behind the Score: Understanding the reasons behind customer ratings is essential for actionable insights.

- The Importance of Benchmarking and Industry Standards: While benchmarking can provide valuable insights, it’s important to develop strategies tailored to your specific needs.

- The Power of Testing Theories: Businesses can test hypotheses about the customer experience by designing targeted questions within NPS surveys.

- The Importance of Employee Engagement: Engaged employees lead to satisfied customers. Employee Net Promoter Score (eNPS) can be used to measure employee engagement and identify areas for improvement.

- Implementing NPS in Your Business: Choose appropriate channels for collecting feedback (email, QR codes, website). Be transparent about the purpose of the survey and the time commitment required.

Why Collect Customer Feedback

“No company can succeed without customers. If you don’t have customers, you don’t have a business. You have a hobby”.

– Managing Customer Relationships: A Strategic Framework by Don Peppers and Martha Rogers.

Knowing how customers feel about your business isn’t just beneficial—it’s vital. Without a strong connection, there is no customer loyalty—no referrals, ultimately impacting your revenue.

One practical way to gain feedback is through the Net Promoter Score (NPS). Though simple, NPS offers you the chance to get inside the hearts and minds of your customers, helping you gauge whether your business connects with them or falls short. While it may not be the most detailed tool, its simplicity encourages higher response rates, making it a straightforward and valuable resource for feedback.

In this article, we’ll explore NPS, how to apply it effectively, and how combining it with targeted questions can reveal deeper insights into how your business is perceived.

What Is a Net Promoter Score?

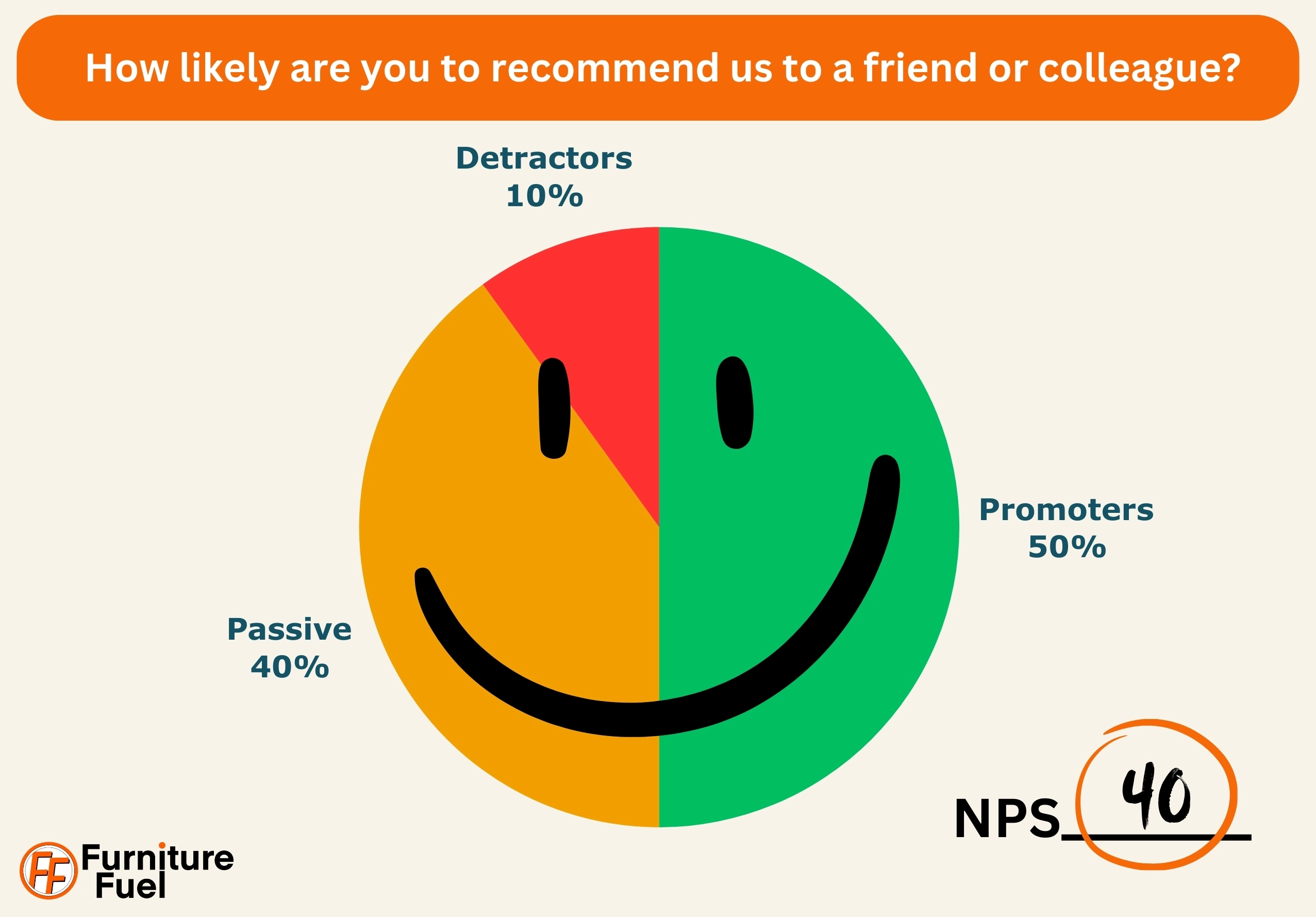

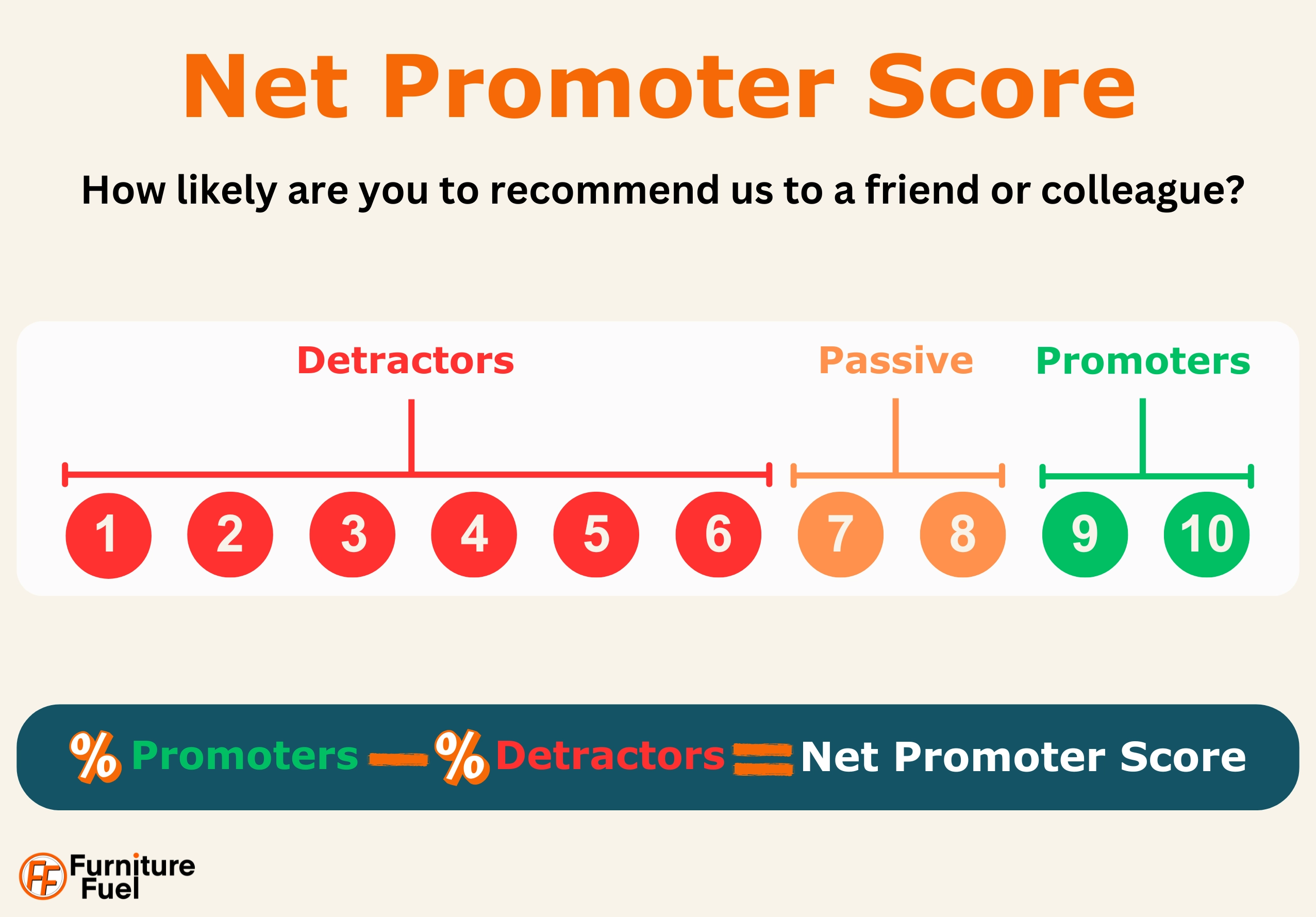

The net promoter score, sometimes called a net promoter system, is a VoC (voice of consumer) measure that helps businesses benchmark customer loyalty. By asking customers how likely they are to recommend your business to others on a scale from 0 to 10, NPS categorises responses into three groups: Promoters (9-10), Passives (7-8), and Detractors (0-6). The final NPS is calculated by subtracting the Detractor’s percentage from the Promoter’s, giving you a score between -100 and 100.

How likely are you to recommend Company X to a friend or colleague?

The Net Promoter Score is the brainchild of Fred Reichheld (2003 – HBR – The One Number You Need to Grow), a Bain Fellow at Bain & Company. Recommended book – The Ultimate Question 2.0.

This score isn’t intended to provide deep feedback on its own but serves as a high-level metric to track trends in customer opinion over time. It truly is the “ultimate question,” to borrow Reichheld’s phrase. If customers aren’t willing to recommend you, you will run out of the most valuable resources. As Don Peppers and Martha Rogers state in rules to break and laws to follow, customers are a finite resource. You are only borrowing them from another business. So, give them a reason to return and recommend you.

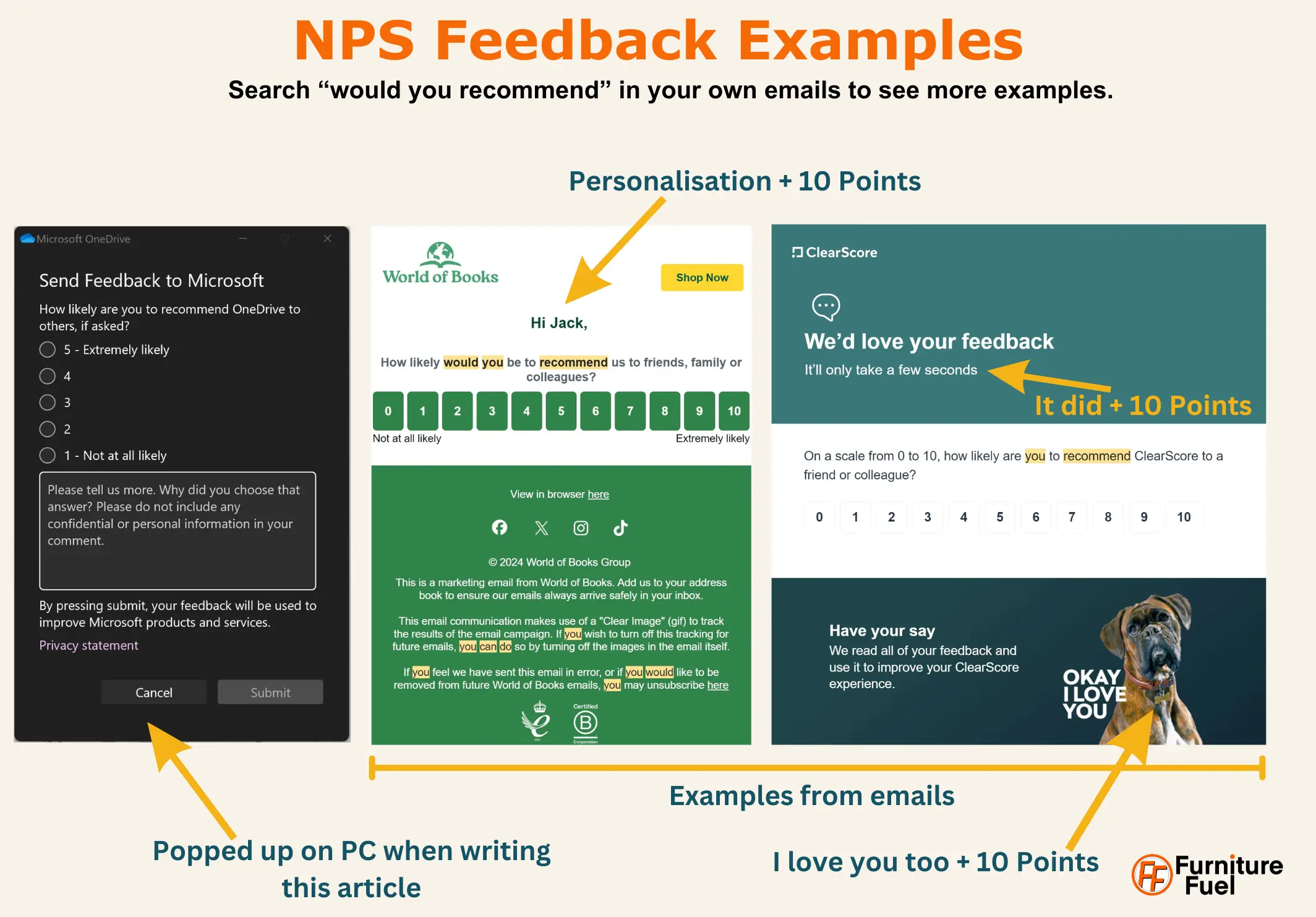

The +10 points do not relate to the NPS score. It is to show where particular examples are more effective than others.

Dumbledore – “10 points to Neville Longbottom”

Promoters, Passives and Detractors

Promoters (Scores 9-10)

Promoters are your most loyal and enthusiastic customers. They are highly satisfied with their experience and are likely to recommend your business to others, making them valuable assets in terms of word-of-mouth marketing. Since they trust and believe in your brand, they tend to be less price-sensitive, often willing to spend more and repurchase over time.

In addition to reducing your marketing costs by acting as an advocate. Their positive feedback can also improve team morale, as employees see the tangible impact of their work on customer satisfaction. Furthermore, Promoters are more likely to forgive minor issues, showing greater resilience in their loyalty.

Passives (Scores 7-8)

Passives are generally satisfied customers but lack the enthusiasm and loyalty of Promoters. They are pleased with their purchase but are not particularly attached to your brand or business, which makes them more likely to switch to a competitor if they find a better offer. They are neither highly likely to recommend your business nor are they likely to leave negative feedback unless they encounter a specific problem.

Passives present both an opportunity and a risk. Since they are fairly neutral, they don’t actively contribute to negative brand perception. However, they also don’t help spread positive word-of-mouth. They represent a group that, with the right improvements, could potentially shift into Promoters, making them a critical segment for loyalty-building efforts.

Detractors (Scores 0-6)

Detractors are customers who have had a negative experience or are unsatisfied with your product or service. They are unlikely to recommend your brand and may even share their dissatisfaction with others, potentially damaging your reputation through negative reviews or word-of-mouth. Detractors are often price-sensitive and may not consider buying from you again.

They pose the highest risk to your business’s reputation and can impact customer acquisition efforts if their complaints reach a larger audience, which is far easier today with social media. Their feedback is invaluable, however, as it often highlights critical areas where improvements can significantly impact the overall customer experience. Addressing Detractors’ concerns quickly can sometimes turn their opinion around, making them loyal customers over time.

Net Promoter Score + Why?

“But, a calculation is not enough. There’s another critical question we discovered as we learned more: “Why?” Asking a customer to tell us in their own words why they gave a score is what helps us understand how we can take action and continuously improve. We also found that going from calculation to improvement required a system, and, so the Net Promoter System was born.” – The History of Net Promoter® – Bain and Company.

Using NPS alongside an open-ended follow-up question like “Can you tell us why?” or “What is the main reason for your score?” provides an understanding of why customers feel that way. The NPS 1 to 10 score gives you a quick overview of customer loyalty and satisfaction, allowing you to see trends over time.

The follow-up question invites customers to share their thoughts, helping you understand the reasons behind their scores. This qualitative feedback is essential for identifying areas for improvement related to your business and its offering. By analysing the responses, you can determine whether customers perceive your offerings as unique or competitively priced, which can guide strategic adjustments.

Asking why allows feedback from all three types—Promoters, Passive and Detractors. NPS tends to focus on the extremes (Promoters and Detractors), often overlooking feedback from Passives, which could contain valuable insights. Asking only detractors for feedback overlooks valuable insights from promoters, who can provide insight into what’s working well.

How do Net Promoter Scores work?

As stated above, the NPS calculates how many respondents to a question asked (net) are promoters—those who have a positive impression of your business, greater loyalty to your business, and, best of all, give your business word-of-mouth referrals.

The question normally asked is, “How likely are you to recommend Company X to a friend or colleague?” The respondent is then asked to answer the question on a scale of 1 to 10, with 10 being the most likely to recommend and 1 being the least likely.

Those who score 1 to 6 are Detractors, 7 to 8 Passives, and 9 to 10 Promoters.

The Formula for Net Promoter Score

The formula is as follows.

%Promoters – %Detractors = Net Promoter Score.

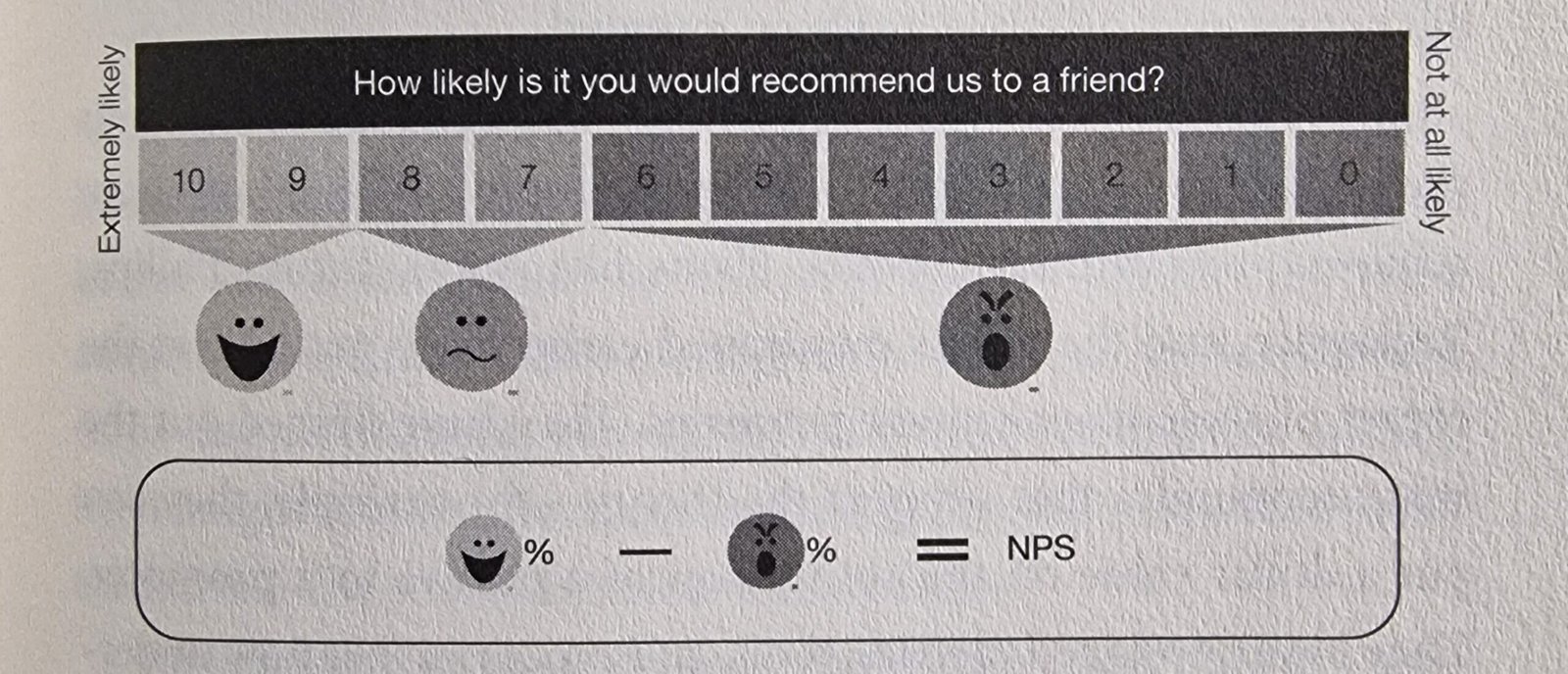

The scale on an NPS is usually depicted from 0 to 10, with 10 representing the most positive feedback. This means that a “10” indicates a customer is highly likely to recommend your business, while a “0” reflects a highly dissatisfied customer who is unlikely to recommend.

It’s important to clarify this scale to customers, as Reichheld & Markey point out, we are primed throughout life to think “1” represents the highest rating, being number 1 or winning 1st place, for example. You might consider testing the scale flipped, starting at “10”, reflecting the best score, helping ensure customers don’t accidentally select “1” when they mean “10.”

Image taken from the book The Ultimate Question 2.0 – Fred Reichheld and Rob Markey – Introduction Pg7

Net Promoter Score Formula Example

If you sent out an email to 600 customers and you received 250 responses, with 95 being Detractors, 100 being Passives, and 55 being Promoters, you would calculate the Net Promoter Score (NPS) by:

- Calculate the percentages:

- Passives: 100 / 250 = 40% (not used in the NPS calculation)

- Detractors: 95 / 250 = 38%

- Promoters: 55 / 250 = 22%

- Calculate the NPS:

NPS = % Promoters – % Detractors

NPS = 22% – 38% = -16

So, your NPS score would be -16.

Net Promoter Score Calculator

Number of Promoters:

Number of Passives:

Number of Detractors:

Results

A Possible Limitation of NPS

A small number of responses may not accurately represent the broader customer base, leading to skewed results. Since NPS hinges on the ratio of promoters to detractors, it’s essential to ensure that this ratio reflects the overall customer base. Ideally, a larger sample size increases the reliability of the NPS and makes it easier to detect trends over time. If the number of respondents varies significantly from one survey to another, comparing results over time can be challenging. For example, if you get 250 responses one month and only 100 the next, it may create fluctuations in your NPS that don’t reflect actual changes in customer sentiment.

Additionally, if your feedback collection method attracts certain types of customers (e.g., more satisfied customers or more dissatisfied ones), this can skew the results, leading to potentially misleading interpretations. A well-balanced, stable sample size helps ensure that NPS accurately represents the broader customer sentiment.

Tracking NPS results over time can still provide a meaningful idea of customer satisfaction trends. By monitoring scores over a longer period, broader patterns will emerge, even if individual scores fluctuate due to variations in sample size or respondent type.

What Is a Good Net Promoter Score?

A good Net Promoter Score can vary significantly by industry, but generally, a score above 0 is considered acceptable, while anything above 50 is regarded as excellent.

Scores Below 0: There are more detractors than promoters, suggesting significant issues with customer satisfaction and loyalty.

Scores from 0 to 30: Indicates a moderate level of customer loyalty. While you have more promoters than detractors, there’s room for improvement.

Scores from 30 to 50: This is considered a good NPS, reflecting a generally positive customer perception and loyalty.

Scores Above 50: Excellent NPS, showing a strong base of promoters who are likely to recommend your business to others.

Scores Above 70: Exceptional NPS, indicating a very high level of customer loyalty and satisfaction.

Industry Benchmarking NPS

It’s important to note that the average NPS can differ widely across sectors; however, benchmarking, in general, should be used with caution. Rather than directly comparing your NPS against competitors or industry averages, we recommend focusing on your internal trends and improvements.

Benchmarking against competitors can be done with a degree of accuracy, using a double-blind survey, for example. However, at times, with uncertainties and time sensitivity involved, it’s often more practical to benchmark your own business now and then measure again after making improvements. Open-ended responses about why customers gave their scores often reveal comparisons to other retailers who may excel in certain areas, providing insights into where you can focus your efforts for improvement.

Focusing on internal benchmarks has its advantages:

Response Rate Variability: Differences in response rates can skew NPS results. If a competitor achieves a higher response rate, their score may reflect a more engaged customer base, potentially leading to misleading comparisons.

Instead, focus on your own response rate and aim to improve it over time. This will provide a clearer picture of your customer engagement.

Unique Customer Base: Every business has a unique customer demographic and experience. What works for one company may not necessarily apply to another. By establishing your benchmarks based on your customer’s feedback, you can develop targeted strategies that address your specific strengths and weaknesses rather than chasing an industry average that may not resonate with your audience.

This can motivate your team to strive for continuous improvement and provide a clearer understanding of success in your unique context rather than being disheartened because they aren’t as good as x company.

Double-Blind Surveys: In a double-blind survey, neither the respondents nor the survey administrators know which company or brand is being evaluated. This method is particularly useful in competitive benchmarking, as it helps eliminate biases that could influence responses, ensuring that the feedback reflects genuine customer experiences rather than pre-existing brand loyalty or recognition. Providing, in theory, more reliable insights into customer perceptions.

What to ask? Net Promoter Score Question

To effectively gauge customers’ impressions of your business, you must ask the right questions. While Reichheld’s “How likely are you to recommend Company X to a friend or colleague?” is the ultimate question, you can use other questions in the NPS system. One of the benefits of this system is that it is open source—you can tailor it to your needs.

However, one concern with making the feedback longer than necessary is that it makes the customer “analysis instead of action” – Reichheld & Markey – The ultimate question 2.0.

When feedback forms are too long or complex, customers may spend more time thinking about their responses and analysing the company’s performance rather than simply deciding whether or not to do business with them. It also risks overwhelming teams with excessive data, complicating efforts to identify the most effective actions for enhancing customer satisfaction.

A single, focused question, like the NPS question, is designed to gauge customer loyalty simply and directly. By asking, “How likely are you to recommend us to a friend or colleague?” NPS aims to capture the essence of customer sentiment in a straightforward way. This simplicity makes it easier for companies to act on the results without getting bogged down in lengthy analysis of multiple responses. Adding too many questions can dilute the key insights, making it harder to pinpoint clear patterns or priorities for improvement.

Keeping feedback forms concise and focused on critical questions encourages customers to provide direct, actionable feedback. While longer feedback forms can work and should be considered for the initial feedback to build the biggest possible picture, feedback asked after the point of sale or delivery should be kept simple for the reason discussed above. In large organisations, different departments may have varying feedback needs, but it’s important to consider whether each additional question contributes directly to improving the customer experience.

Testing Theories and Refining Customer Experience

A Net Promoter System could allow businesses to explore specific customer experience hypotheses, aligning with Peter Drucker’s philosophy that assumptions need to be tested. NPS surveys could incorporate targeted questions based on suspected friction points or strengths. For instance, if you think that delivery options could be affecting customer loyalty, including an additional question on delivery satisfaction could validate or disprove this theory.

Peter Drucker was a highly influential management consultant, educator, and author, often called the “father of modern management.” His work revolutionised the way organisations approach leadership, innovation, and strategy. Drucker emphasised the importance of customer focus, effective decision-making, and the role of employees in driving business success. His ideas on decentralisation, knowledge work, and organisational culture remain foundational in business and continue to shape management practices worldwide.

NPS-Style Questions

These questions could help you identify specific areas for improvement to enhance customer satisfaction.

- Do you find our products to be good value for the price?

- How satisfied are you with the overall quality of our products?

- How often do our products or services exceed your expectations?

- How consistent is our quality across different product categories?

- How satisfied are you with our customer service?

- How likely are you to trust our brand over competitors?

- Do you feel that our brand aligns with your values?

- How well do our products meet your needs?

- How satisfied are you with the shopping experience on our website?

- How often do you feel we offer relevant or useful content?

- Do you feel we understand your needs as a customer?

- How well do we respond to your questions or concerns?

- How likely are you to try a new product from us?

- How well do we communicate with you post-purchase?

- Do you feel that our returns policy is fair and easy to understand?

- How likely are you to leave a positive review for our products or services?

- How satisfied are you with the speed of our delivery?

- Do you feel our brand offers good long-term value?

- Do you feel you get enough information about our products before purchasing?

- How satisfied are you with our after-sales support?

Some of our favourite questions to include in initial surveys are:

- How long have you been a customer of [insert business name]? (This helps with calculating Customer Lifetime Value and understanding customer loyalty.)

- How did you first hear about us? (This can help determine if a customer was referred by someone, which is valuable for understanding promoter influence and referral potential.)

- What was the main reason you chose to buy from us? (Helps identify key motivators and could indicate factors that would make a customer likely to recommend your business to others, in addition to identifying possible promoter influence.)

Ensure that the questions you’re asking are clear and easily understood by your customers. What may seem straightforward to you could be confusing for someone unfamiliar with your business or the terminology you use. Some of the questions we’ve provided as examples could be refined to make them more accessible and relevant to your audience.

If your questions are easy to comprehend, you improve the quality of your feedback and increase the likelihood that customers will feel comfortable and willing to respond.

Our weekly newsletter provides digestible content on business strategy, marketing tactics and behavioural economics designed to fuel your furniture business.

Additional Areas to Use Net Promoter System in Your Furniture Business

A screenshot from Richard Branson’s Twitter

Net Promoter Score (NPS) and Employee Engagement

“Take care of your employees and they will take care of your business. It’s as simple as that. Healthy, engaged employees are your top competitive advantage.” – Richard Branson

Net Promoter Score (NPS) is primarily used to measure customer loyalty and satisfaction, but it can be applied to employee engagement and is increasingly recognised as valuable. When applied internally, NPS can assess how likely employees are to recommend their workplace to others, offering insights into their engagement, satisfaction, and loyalty to the business.

When employees are engaged and genuinely enjoy their jobs, they create positive customer experiences, strengthening customer loyalty and satisfaction. Net Promoter Score (NPS), traditionally used for measuring customer satisfaction, can also be applied internally to measure employee engagement.

The link between employee engagement and customer experience is well-documented: Engaged Employees Create Better Customer Experiences, The Surprising Link Between Customer Experience And Employee Engagement.

Engaged employees are typically more invested in their work, exhibit positive attitudes, and deliver better customer service, directly impacting customer satisfaction.

Often called eNPS (employee Net Promoter Score), it reveals how likely employees are to recommend their workplace. A high eNPS suggests that employees feel valued, connected, and motivated, making them more likely to go above and beyond in customer interactions. However, a low eNPS can signal underlying issues such as dissatisfaction or disengagement, negatively affecting customer interactions and ultimately reducing customer loyalty.

Using eNPS this way offers a measurable link between employee satisfaction and customer outcomes, reinforcing the idea that a positive internal culture translates to a strong, loyal customer base.

Small Teams Drawback

Using Net Promoter Score (NPS) to measure employee engagement can pose unique challenges for small teams. Unlike larger companies, where individual responses blend into a broader dataset—small teams often find it difficult to ensure total anonymity, especially when employee responses might reveal specific feelings that could be traced back to individuals. This perceived lack of privacy can discourage employees from providing genuine, constructive feedback due to potential repercussions, leading to less accurate eNPS results.

Understanding Employee NPS (eNPS)

The eNPS is based on a straightforward question: “On a scale of 0-10, how likely are you to recommend this company as a place to work to friends or family?” Employees are categorised the same as customers: Promoters (9-10 scores), Passives (7-8), and Detractors (0-6). The formula for calculating eNPS is the same.

eNPS= the percentage of Detractors – the percentage of Promoters.

A high eNPS indicates a motivated workforce, while a low eNPS suggests underlying issues affecting productivity, retention, and morale.

Why Use eNPS to Measure Employee Engagement?

Simple and Actionable: eNPS provides an accessible and actionable measure of employee sentiment. Unlike complex surveys, eNPS is easy for employees to complete and straightforward for managers to interpret.

Quick Feedback Cycles: eNPS can be conducted periodically (e.g., quarterly), offering real-time feedback and enabling HR and/or leadership to act swiftly on emerging issues. Remember to ask why follow-up questions for better insight. While eNPS provides a high-level view, it doesn’t reveal the reasons behind the scores. Pairing eNPS with follow-up questions or qualitative feedback allows employees to share specific concerns or suggestions. For example, asking, “What’s the primary reason for your score?” can provide invaluable insights.

Analyse Scores by Department or Demographic: By breaking down eNPS data by departments, tenure, or job levels, companies can pinpoint where improvement is needed. This can be an operational efficiency (doing things better) identifier. You could find a bottleneck in your business that may allow you to reduce costs.

Promote Positive Changes and Recognize Promoters: For Promoters, celebrating their positive feedback by sharing successes or highlighting valued employee contributions can reinforce a culture of appreciation. For Detractors, showing genuine care for their issues and addressing common themes can improve morale and trust.

Focus on Career Development and Work Environment: Common reasons for low eNPS scores often relate to career growth and workplace culture. Investing in training, mentorship, and a supportive work environment can address some of the root causes of dissatisfaction, leading to a more engaged workforce over time.

eNPS offers a powerful yet straightforward method for understanding employee sentiment and identifying opportunities to boost engagement. Regularly measuring and acting on eNPS results enables companies to create a more positive work environment, fostering loyalty, enhancing performance, and ultimately driving the business forward.

Strategic Position

The Net Promoter Score (NPS) framework could be used to clarify your business’s strategic position in the eyes of the customer. This can help you align your offerings with the principles of Porter’s Generic Strategies, which we explored in the last article—whether you’re targeting cost leadership, differentiation, or a focused strategy.

If you’re struggling to pinpoint where your business stands, for example, if your goal is to differentiate your products through quality or unique design, the right feedback can help you discover which specific features resonate most with your customers. Alternatively, gathering insights on price perception and perceived value can significantly inform your pricing strategies if you are pursuing cost leadership.

If you’re uncertain about your generic position, NPS-style questions can help you identify and refine your strategic approach, ensuring you effectively meet customer expectations and enhance overall loyalty.

Cost Leadership NPS Questions

- Do you feel our prices are competitive compared to other furniture businesses?

- How satisfied are you with the balance between our product quality and price?

- Do you believe we offer good value without compromising quality?

- How often do you find lower-priced alternatives to our products?

- How important is price when choosing between us and competitors?

- Do you feel we offer a good range of affordable products?

- How likely are you to choose our brand based on pricing alone?

Differentiation NPS Questions

- Do you feel our product offering is unique compared to others?

- How much does our business stand out to you vs other businesses?

- Do you believe we offer unique features or qualities not found in other brands?

- How much does our business’s reputation influence your purchasing decision?

- Do our product designs or styles feel unique compared to competitors?

- How much would you say our quality justifies the price?

- How important is our brand’s identity in your choice to buy from us?

- Do you feel our customer experience is unique compared to other brands?

- How satisfied are you with the additional services we provide?

- Do you believe our brand represents quality and expertise?

- How satisfied are you with the distinctiveness of our product offerings?

Focus NPS Questions

- How well do you feel our business serves your specific needs?

- How satisfied are you with our selection in (focused product category)?

- Do you feel we understand your needs and preferences when it comes to our products/services?

- How likely are you to recommend our business to others who share your needs?

- How likely are you to choose us for x product?

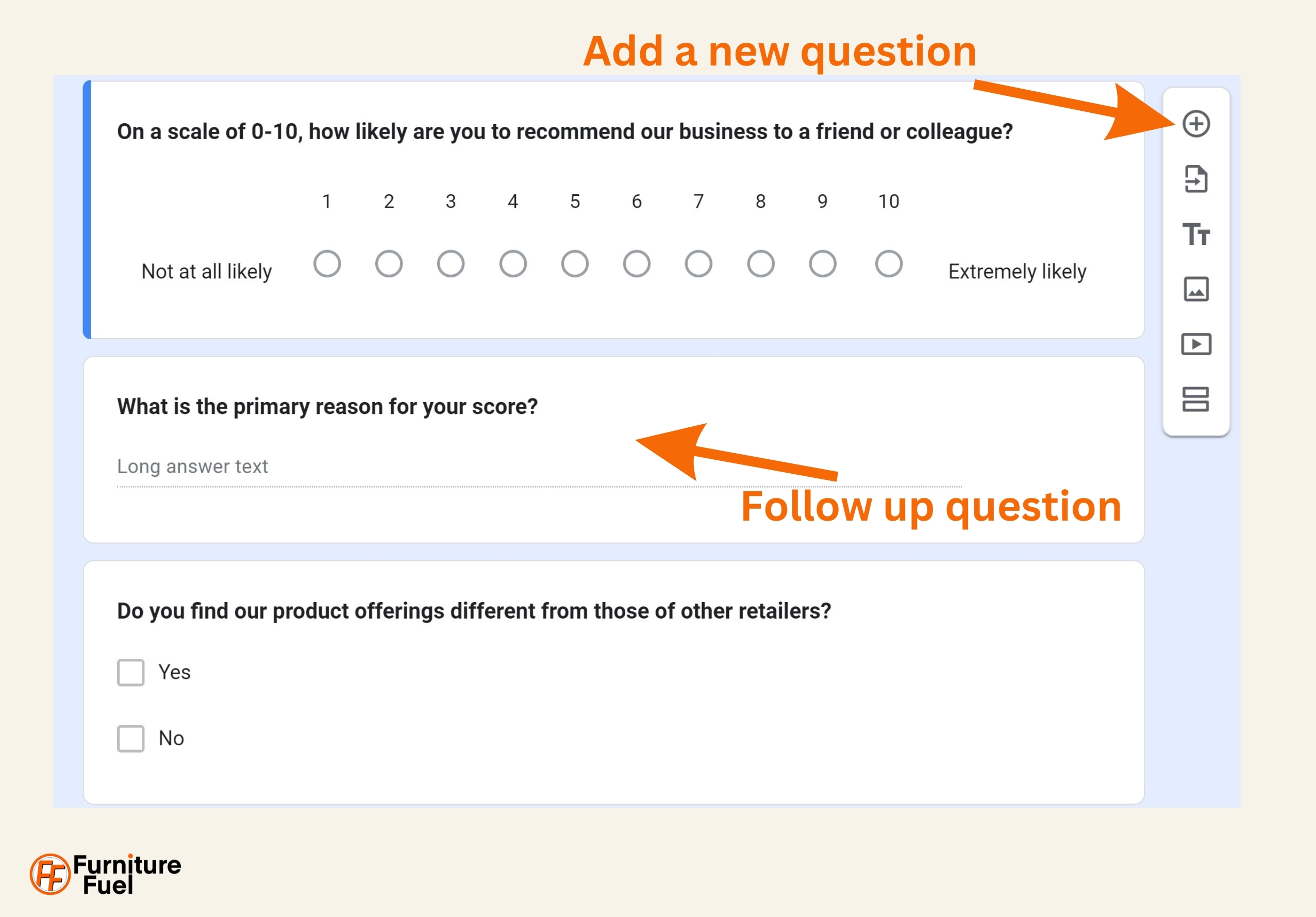

Assessing Your Position: Example Feedback Form

Core NPS Question

- On a scale of 0-10, how likely are you to recommend our business to a friend or colleague? (This is your main NPS question.)

Follow-Up Question

What is the primary reason for your score? (This open-ended question will provide qualitative insights into customer sentiments.)

Assessing Differentiation

- Do you find our product offerings different from those of other retailers? (Yes/No)

- How well do our products meet your specific needs compared to our competitors? (1-10 scale)

- What unique features or benefits do you think we offer that competitors do not? (Open-ended)

Assessing Cost Leadership

- How do you perceive our pricing compared to competitors? (Lower, About the same, Higher)

- Do you believe our prices reflect the quality of our products? (Yes/No)

- Are our promotions and discounts appealing to you? (Yes/No)

Assessing Focus Strategy

- How satisfied are you with our customer service compared to other retailers? (1-10 scale)

- Do you feel we understand your needs and preferences when it comes to our products/services? (Yes/No)

Overall Experience

- How would you rate your overall experience with our business? (1-10 scale)

- What improvements would you like to see in our offerings or services? (Open-ended)

Additional Insight

- What factors most influence your purchasing decisions when buying furniture? (Multiple choice: Price, Quality, Business reputation, Customer service, etc.)

- Would you be willing to participate in a follow-up survey for more detailed feedback? (Yes/No)

Implementing an NPS in Your Business

Implementing a Net Promoter System can be a process that involves time, effort, and, in many cases, investment, but as discussed, all that effort is worth it.

If you haven’t done customer feedback before or it has been some time, an initial questionnaire should be sent out to as many customers as possible. Remember that you should have their consent to do so. Sending a feedback form should aim to build loyalty, not risk breaking trust by reaching out to those who haven’t agreed to be contacted. This initial feedback should give you enough data to work on improvements.

When should you ask for feedback after this? This is a question you can only answer. What are you trying to get insight into by asking for feedback? If it’s how knowledgeable your team is, this would most likely be asked post-sale, as the experience will be fresh in the customer’s mind.

If you want insight into the whole customer experience, asking for feedback after delivery can be more beneficial than after the sale, especially in the furniture industry, where the delivery process heavily influences the customer experience. This can be due to what we discussed in other loyalty articles—the peak-end rule.

Customers can provide insights about the delivery team’s performance, packaging quality, and whether the product met their expectations upon arrival in addition to the initial sale. This information can guide operational improvements.

The peak-end rule is a psychological principle that suggests people evaluate experiences based on their most intense moments (the peaks) and how they ended, rather than the total sum of every moment. This rule implies that the memory of an experience is largely shaped by these two elements, which can influence future behaviours and decisions.

Asking for Reviews at the End of the Feedback Form?

Whether you should ask for a review at the same time as feedback is up for debate. The pros are, especially if they have had an exceptional experience, they will be more motivated to provide a review. The cons, well, if they haven’t had a great experience and you don’t address it correctly, they will be more motivated to provide a bad review.

Some bad reviews aren’t the end of the world for a business. We will discuss this in another article. But things happen. Customers know this. How you handle their problem is what makes or breaks the experience.

Customers might feel overwhelmed if asked for too much input at once. Spacing out your requests—first for NPS feedback and later for a product review—can increase the likelihood of receiving thoughtful responses.

Once you have the initial feedback after delivery, a better approach may be to segment customers based on their responses. For example, Promoters can be invited to leave a review, while Detractors can be offered additional support or solutions to their issues.

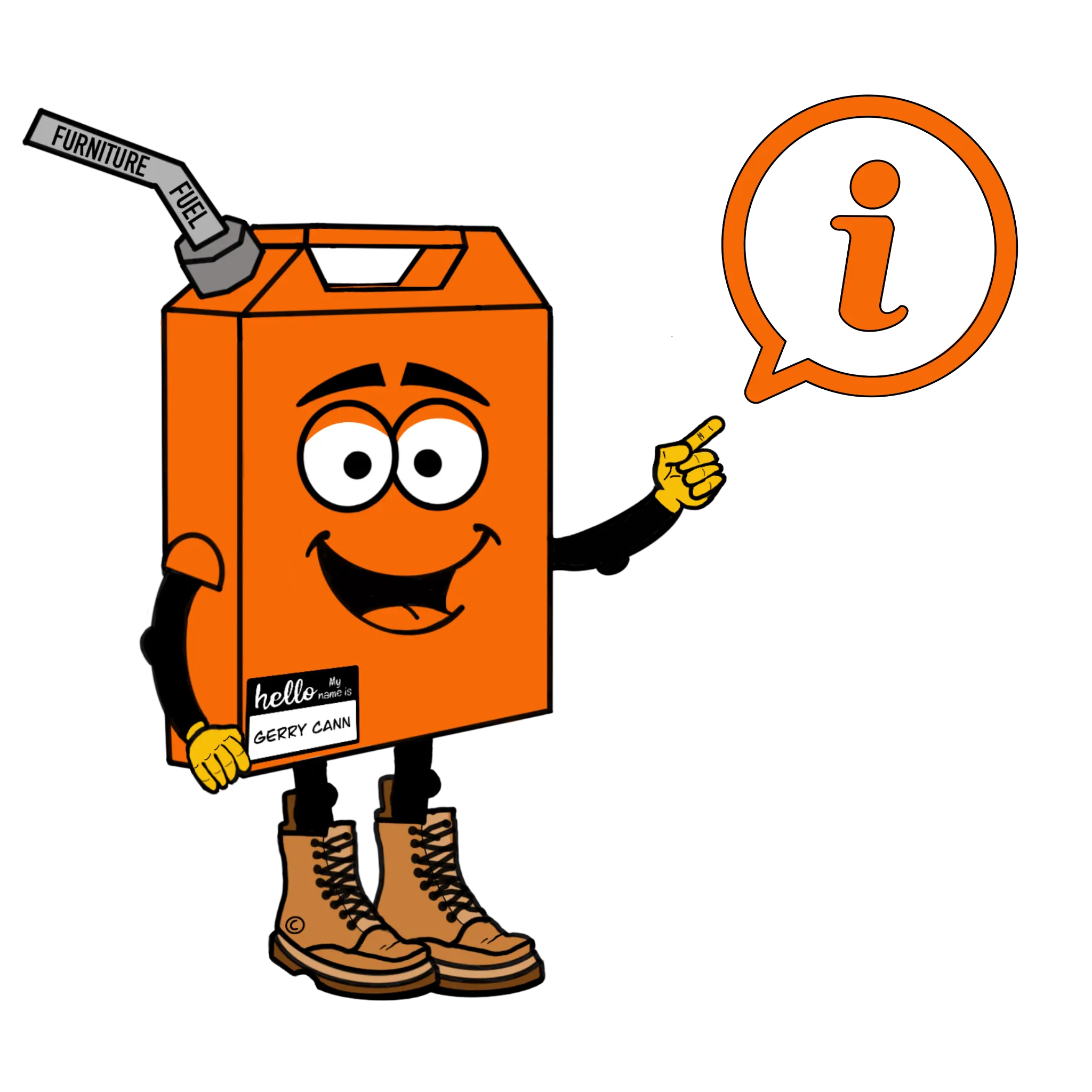

Be Transparent

Transparency about why you are collecting feedback and the length of feedback requests is essential for a positive experience. Some businesses start an NPS survey with a simple “yes or no” recommendation question, which implies a quick response. However, this is a gateway to a longer survey with more questions, which feels misleading and, let’s be honest, is annoying.

When a brief 10-second question unexpectedly becomes a five-minute form, users may abandon the survey or give rushed responses, ultimately reducing the value of the feedback. For mobile users, long surveys can be cumbersome. Text boxes or scrolling on small screens can add to the friction, making it difficult for users to provide meaningful feedback.

To avoid these issues, businesses should communicate upfront about the time required to complete the survey. A simple statement, such as “This survey will take approximately 3-5 minutes to complete,” gives users an idea of what to expect. This approach respects users’ time and encourages genuine feedback, leading to higher-quality insights and a better overall user experience.

Ways to Ask for Feedback

You don’t have to ask for feedback on every sale. Doing so can be overwhelming for small teams. However, it does provide a consistent picture, especially of valued team members, through a spotlight on those who deserve praise, and if needed, this feedback can be used at appraisal time to see what further training team members need and who is best to lead when a position opens.

After-Sales Email – Send an automated email shortly after purchase with additional information on how to use the product, thanking the customer and inviting them to share their feedback. Include a clear call-to-action (CTA) to complete the survey, such as a button that leads directly to the form. This can be the easiest and most straightforward option for customers.

The QR code leads to the example feedback we created for the next section – setting up NPS with Google Forms.

QR Code—Generate a QR code linked to your NPS survey. Print the code on receipts, packaging, or thank-you cards included with purchases. Customers can scan the code to access the feedback form quickly. Make sure you describe or show how to use a QR code. Not everyone will know how to use them, even if you do.

Website Integration – Embed the NPS survey on a dedicated feedback page on your website. Consider using a pop-up or a banner that appears after a purchase confirmation to encourage immediate feedback.

If you find that customers aren’t willing to give feedback, this may be because they are not promoters but passive. You could encourage participation by offering incentives such as discounts on their next purchase, entry into a prize draw, or loyalty points for completing the survey. This can significantly boost response rates.

Regularly check your NPS score. Look for patterns in the qualitative feedback to identify areas for improvement. Use the insights gathered to make informed changes to your products or services. Communicate any changes made as a result of customer feedback back to your audience to show that you value their input.

A Question That Should Be Asked

This is a question that we love from the book Making Websites Win by Dr Karl Blanks & Ben Jesson, Founders of Conversion Rate Experts. Pg 102.

“What nearly stopped you buying from us?”

“The wording can be modified depending on what your company does. It could also end with “from using us” or “from signing up”.

Blanks and Jesson know that this sounds counterintuitive. You would typically want the person who didn’t buy opinion, right? But those who don’t buy from you may not be qualified to do so; they may not be able to afford your products, and so will tell you, “You are too expensive” or that “You don’t have any modern furniture”. As much as you may want or need their money, following their suggestions may make your business no longer an option for those who can afford your prices and like traditional furniture.

By asking, “What nearly stopped you from buying from us?” you find out what may be stopping more customers, who are your target audience, from buying. If, for example, they say that they had to look on another website for specific information relating to the product, how many other customers have gone elsewhere and not come back? How many of them could you now get to convert by providing that information?

Blanks and Jesson also state that these customers have been through your entire sales funnel and that when asked this question, they tend to remember the biggest barrier—the most significant reason for others not to buy.

They don’t say that you shouldn’t ask non-customers questions, but you must know your target audience to assess whether the feedback benefits your business or is a detractor.

Should You Ask if Customers Want to Provide Further Feedback?

Yes, asking customers if they would be willing to provide further feedback can be incredibly beneficial. Not only does it help close the loop on customer satisfaction, but it also accelerates your ability to implement feedback and solutions. By requesting additional insights, you can better address any concerns, improve your offerings, and show customers that you value their opinions by directly talking to the customer via phone, for example.

However, when asking customers if they would be willing to provide further feedback, you could assign them a random reference number when the feedback is sent out instead of asking them to provide a personal identifier like an email address. This reference number is linked to their invoice and details, ensuring that personal data is kept private.

At the end of your survey, consider including a section like this:

“Would you be willing to provide additional feedback? If so, please enter your unique reference number from your email or QR code flyer.”

You can also include the following message to reassure customers of their privacy:

“By entering your unique reference number (provided in your email or on your receipt), we can securely identify your purchase without needing your personal contact details. This random number helps us link your feedback to your purchase while keeping your personal information private. Only we can access this information, ensuring your privacy and allowing us to follow up if you have consented.”

This method ensures transparency and builds trust with your customers, encouraging them to participate without any privacy concerns.

Setting up NPS With Google Forms

There are many ways to get NPS feedback from customers. Popular options include Google Forms, SurveyMonkey, Typeform, or dedicated NPS tools like Delighted. These platforms allow for easy creation, distribution, and analysis of feedback. However, Google Forms can be one of the most cost-effective options.

Having a Gmail account is necessary to set up and use Google Forms, but once you have it, the process is straightforward and user-friendly, allowing you to gather customer feedback efficiently.

Setting up Google Forms

Step 1 – If you don’t already have a Google account, you can create one for free. Visit the Google Account creation page to get started.

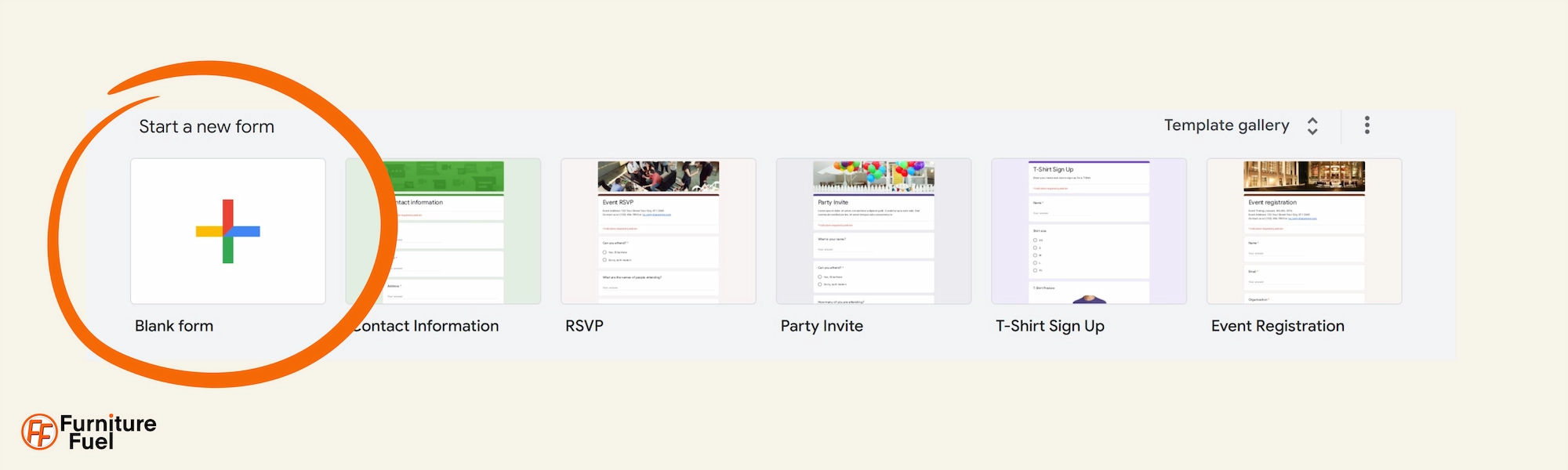

Step 2 – Once you have a Google account, go to Google Forms. You can access it directly or through Google Drive by clicking on “New” and selecting “Google Forms.”

Create Your Form

Step 1 – Click on the “+” button to create a new form

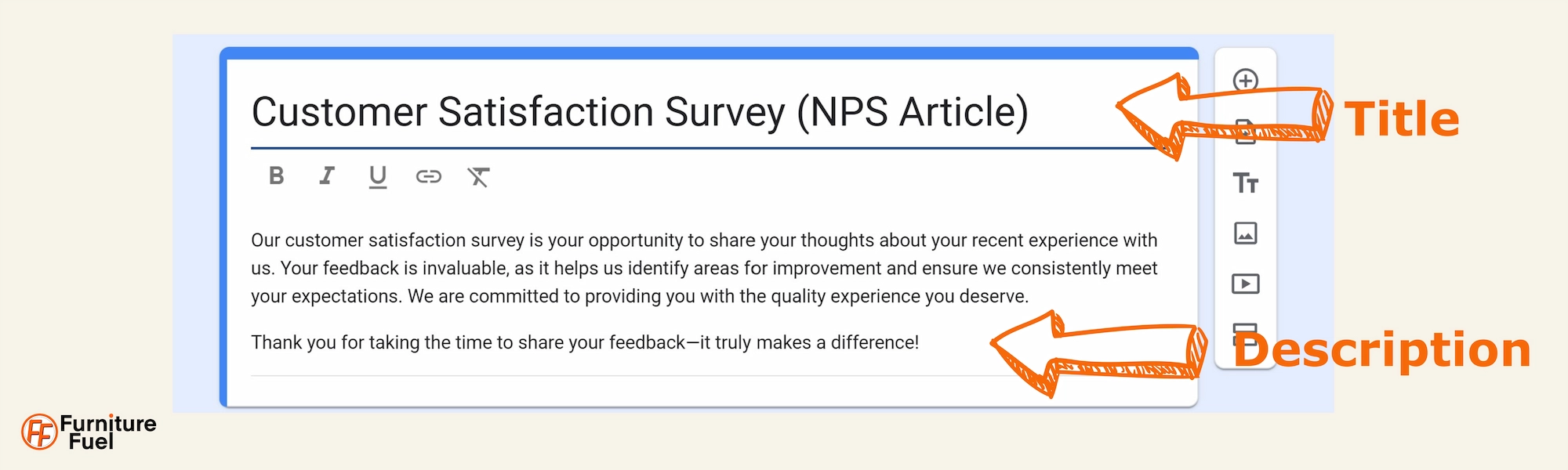

Step 2—Title Your Form. Give your form a title (e.g., “Customer Satisfaction Survey” or “Net Promoter Score Survey”) and a description. Telling customers why you are collecting the feedback increases the chances that they will fill it in, and it reinforces the transparency discussed earlier.

Step 3 – Add Your NPS Question

- Create a new question by clicking the “+” button.

- Choose the “Multiple choice” or “Linear scale” question type. You could ask the question: “On a scale of 0 to 10, how likely are you to recommend our product/service to a friend or colleague?”

If using a “linear scale,” set the scale from 0 (not at all likely) to 10 (extremely likely).

Google Forms is very intuitive. When you add your question, it often auto-fills the type of question it thinks would work the best.

Add another question to gather qualitative feedback: “Please tell us why you gave that score.” You can set this as a “Short answer” or “Paragraph” type question.

You can add further questions if you think doing so would provide more insight, but remember the trade-off mentioned earlier. Customers may spend more time thinking about their responses and analysing the company’s performance rather than simply deciding whether or not to do business with them.

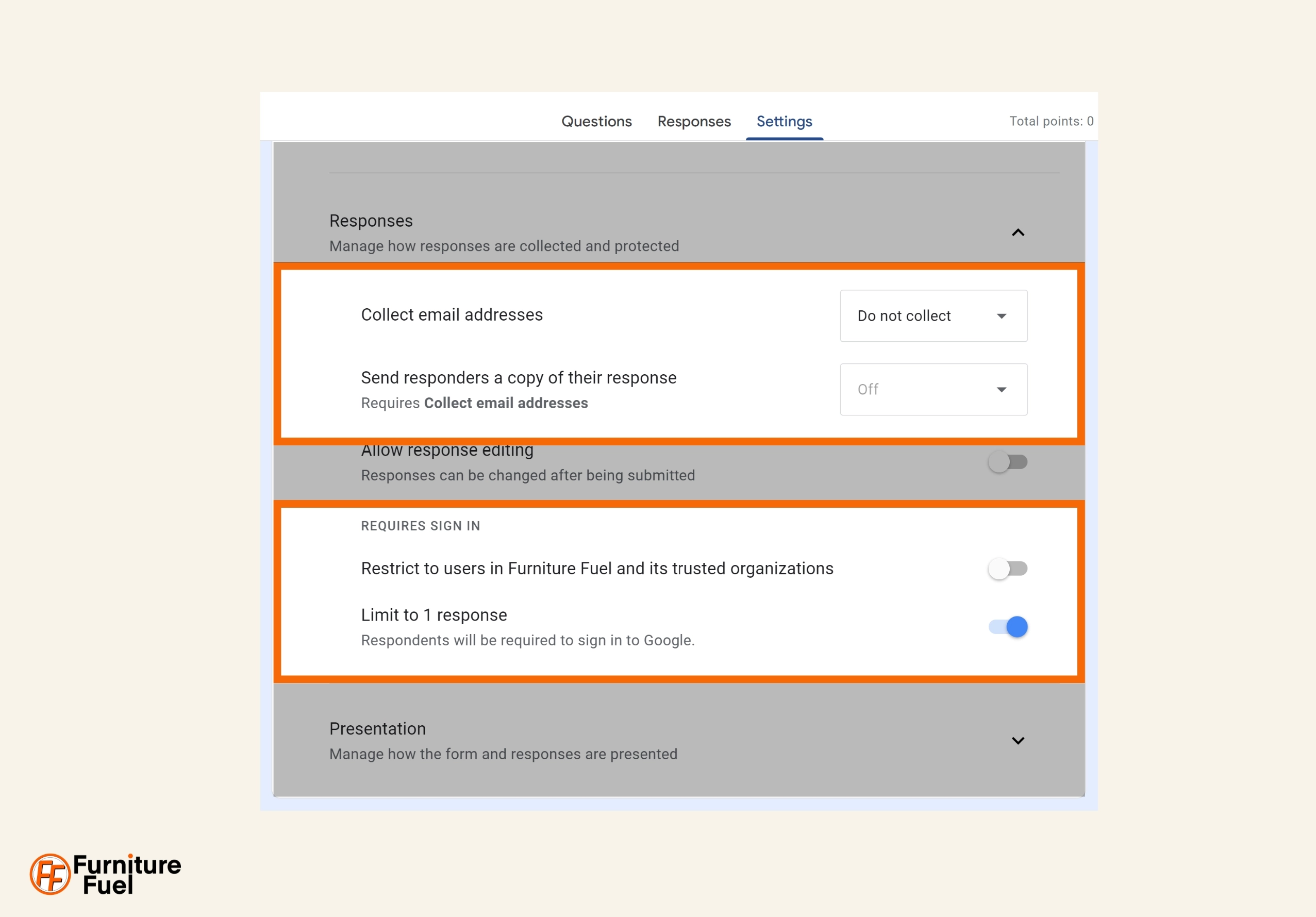

Step 4 – Settings

Click on the gear icon (Settings) in the top right corner.

Under the “General” tab, you can choose whether to collect email addresses, limit to one response per person, and whether respondents can edit their responses after submission.

Unless you are asking if they want to get involved in more feedback, there is no reason to collect emails on this occasion. It will likely increase response rates, and it also makes sense for GDPR considerations. You should include that no email addresses are collected in the description to increase transparency.

Remember, when asking customers if they would be willing to provide further feedback, you could assign them a random reference number instead of asking for a personal identifier like an email address.

The tab to restrict users means you would need to log in to complete the feedback form. You want as many people as possible to compete, so this just adds friction.

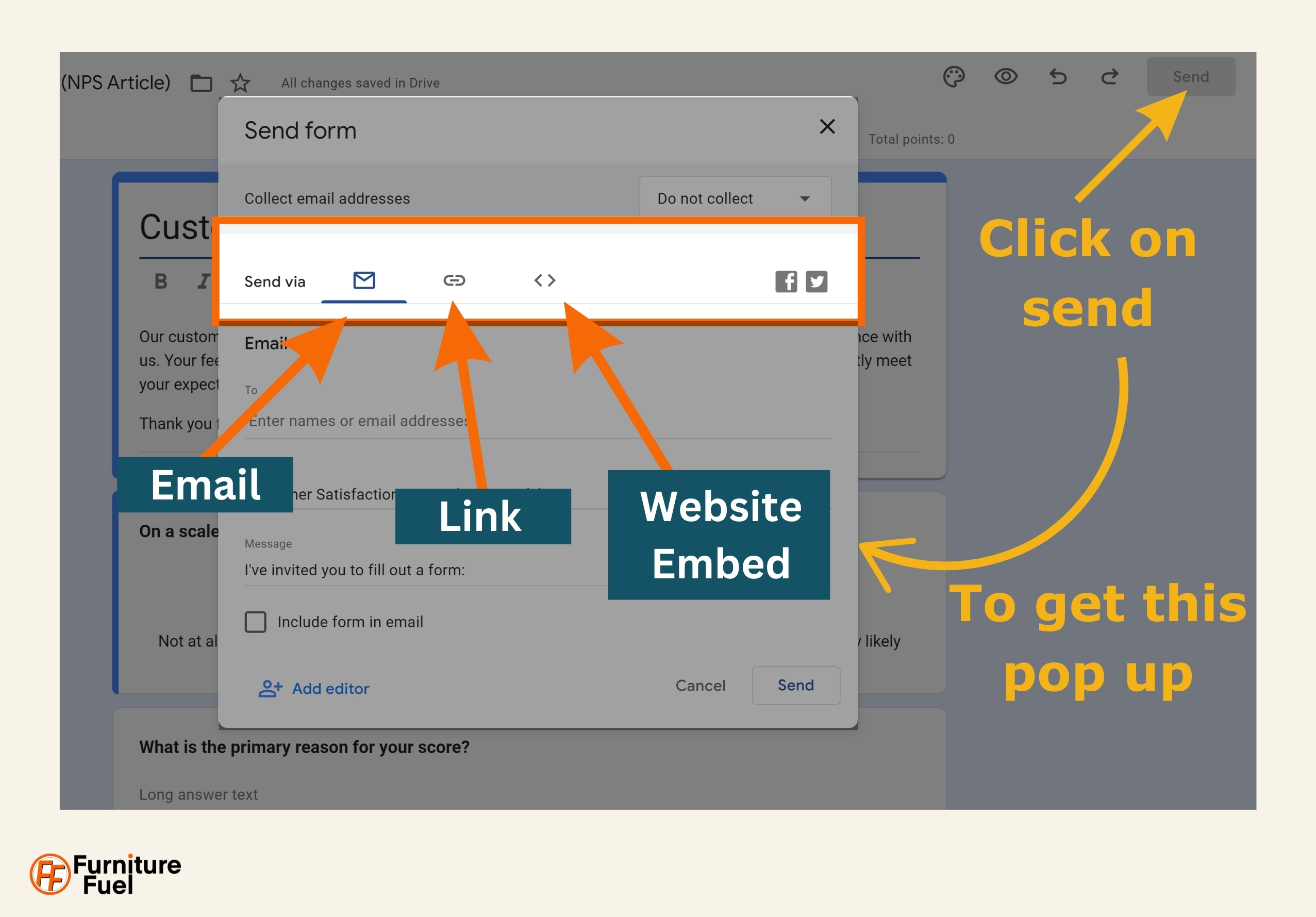

Step 5 – Share Your Form

Click the “Send” button in the top right corner. You can share the form link directly via email, get a link, or embed it on your website.

Most of the time, the link is the best option. If you have set up a free Gmail account, then if choose to send via email on this screen, it would send from that created email account. With this being a new account, the receiver’s email provider may treat the email as spam. Aside from this, for added trust, you should send it from your usual business email address, which your customers are used to seeing. They can also verify the address with the one on your website.

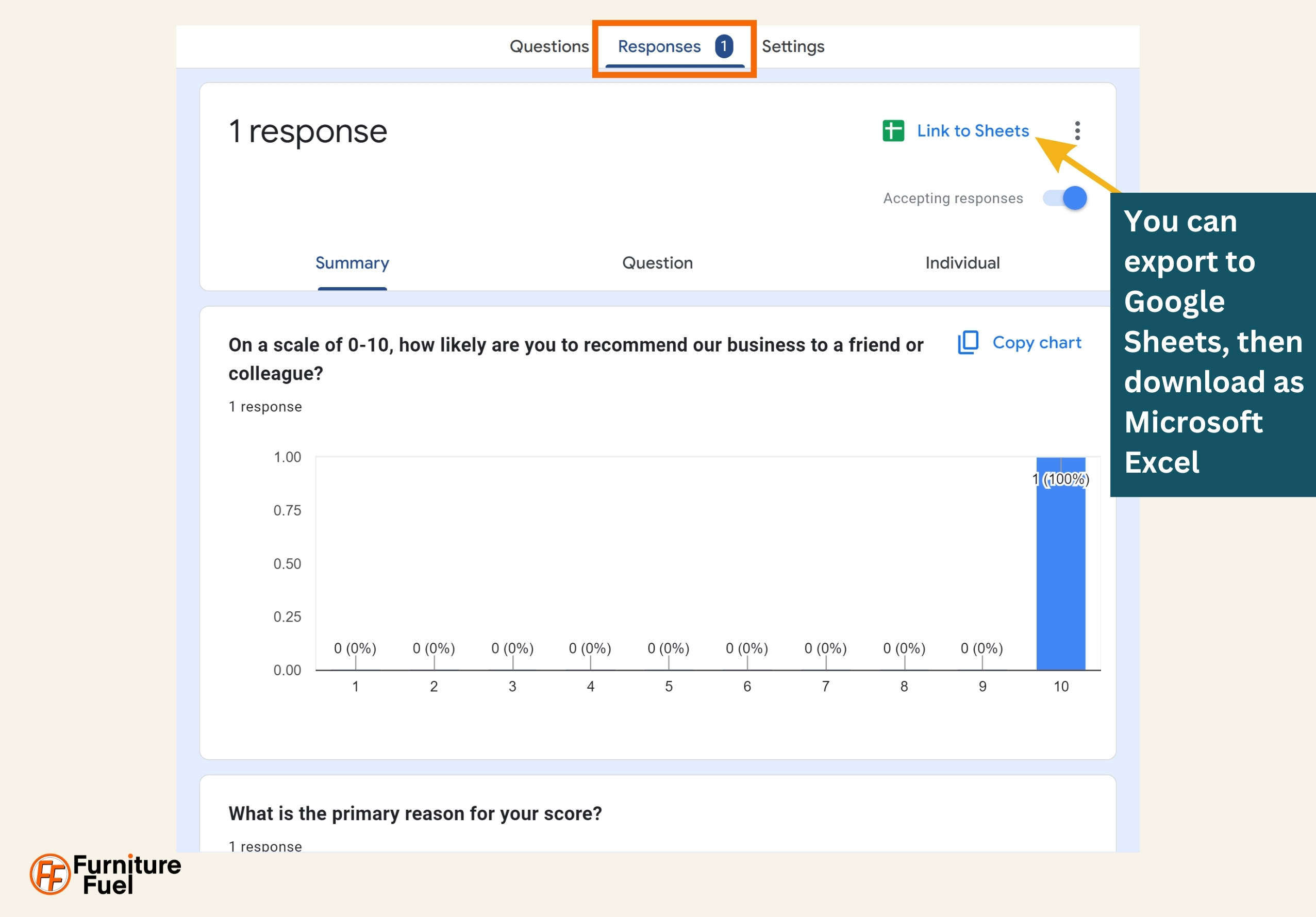

Step 6 – View Responses

Once responses start coming in, you can view them by clicking on the “Responses” tab at the top of your form.

Google Forms provides a summary of responses, including graphs for the NPS score, and you can also download responses as a Google Sheets file for further analysis.