Wholesale vs Importing: Key Trade-Offs You Need to Consider

Jack Young

- Last Updated: 29 April 2025

Table of Contents

Key Takeaways – Buy Wholesale or Import Direct?

- Sourcing impacts your business model – Whether you choose wholesale, importing, or local manufacturing, each option has trade-offs in terms of cost, control, and scalability.

- Wholesale offers convenience and lower risk – It allows for faster stock replenishment, established supplier support, and reduced upfront investment.

- Importing provides higher margins but requires more management – While it offers unique products and better profitability, it comes with longer lead times and higher logistical risks.

- Locally sourced products can enhance quality and sustainability – UK and European manufacturers often offer shorter lead times, ethical production, and substantial branding opportunities, but these benefits come at a premium cost.

- Long-term strategy matters – Consider how your sourcing model will scale as your business grows, balancing risk, margin, and operational complexity.

- Align sourcing with your business goals – Determine whether stability and fast delivery (wholesale) or higher margins and unique products (importing) align better with your long-term strategy.

- A hybrid approach may offer the best of both worlds – Combining wholesale and importing can provide flexibility, diversification, and a competitive edge.

TLDR - Core Summary: Choosing the Right Sourcing Strategy

Your sourcing strategy—wholesale, importing, or local manufacturing—should be aligned with your business goals, operational capacity (including the ability to manage logistics, customs, and warehousing), and market positioning. Wholesale offers lower risk, faster stock replenishment, and established supplier support, making it ideal for businesses prioritising reliability. Importing provides unique, high-margin products but comes with logistical challenges, higher upfront costs, and longer lead times. Sourcing locally from UK or European manufacturers offers quality assurance, ethical production, and sustainability benefits but requires a premium pricing strategy. A hybrid approach—combining wholesale and importing—can strike a balance between risk, diversification, and scalability, leading to long-term success.

Why Do You Need a Buying Strategy?

The barriers to entry are low for entering the furniture industry. The minimum requirement is a laptop. Retail is becoming increasingly competitive on a daily basis, and everyone is seeking ways to boost their margins not just to survive but to thrive.

There seems to be an endless discussion going on—a kind of tug-of-war about whether it is better to buy wholesale or import. The answer seems simple for some: lose a bit of flexibility for increased margins. It is rarely this simple. There are various factors to consider, many of which relate to your business, but some even relate to the type of person you are.

So, when faced with the question of whether to buy products wholesale or import, how do you determine what is best for your business?

Spoiler alert: There is no one-size-fits-all answer.

The Basics: Wholesale vs. Importing

Buying Wholesale

When you buy wholesale, you purchase products from established suppliers or distributors who typically handle inventory storage and logistics on your behalf—some even handle order fulfilment. This means you don’t have to worry about managing stock levels or dealing with the complexities of international shipping. The supplier is responsible for sourcing, storing, and delivering the products directly to you or the customer, which can save you time and reduce the risks associated with holding inventory.

The main downside is that you may be selling a product that many other retailers sell. However, for retailers, wholesale offers a relatively straightforward and lower-risk solution with more predictable lead times and established pricing. It allows you to focus more easily on sales and customer service without getting bogged down in supply chain management.

Importing

Importing involves directly sourcing products from manufacturers, typically overseas, such as in Asia. This approach gives you more control over certain areas, allowing you to negotiate prices or customise products. While importing can lead to higher margins due to lower unit costs, it introduces more complexity. You’ll need to manage the logistics of shipping, customs, and warehousing yourself, which can increase risks such as delays, unexpected costs, and potential stock shortages. Though, there are specialist third parties, such as customs agents or import brokers, who can assist you with managing these aspects.

Importing also requires a higher level of market knowledge and involves a greater upfront investment. Still, there are significant rewards in terms of profit margins and product exclusivity for businesses that can handle these challenges.

On a very simplistic level, the whole discussion is a trade-off between flexibility and increased profitability. Wholesale offers flexibility and simplicity, making it easier to react to a changing market, while importing provides better control over pricing and product selection but requires a greater commitment and carries more risk.

Should You Buy Wholesale or Import

The Key Pros and Cons of Buying Wholesale or Importing

“Late payments are a pervasive issue for UK SMEs. According to a report by the Federation of Small Businesses (FSB), around 50,000 SMEs close annually due to cash flow problems primarily caused by late payments”. – EQUIFAX

Cash Flow Impact: How Much Can You Afford to Tie Up in Stock?

Wholesale suppliers often allow for smaller, more frequent orders, making it easier to manage cash flow. You typically only order when your customer places an order with you. Payment terms may also be more favourable, with most suppliers offering 30-day credit, helping businesses stay afloat.

Don’t expect credit terms from new suppliers on your first order. Some offer credit terms from the first order, but most will likely provide a pro forma invoice, requiring payment before delivery. Then, once a relationship is established, terms may be given.

Importing by ordering directly from manufacturers typically requires large bulk purchases, which can strain cash flow. Payments are generally required upfront or in instalments at certain milestones, meaning capital is tied up in inventory long before you will see a return. However, once sold, the higher profit margins can make up for this.

Inventory Management: Handling Stock Efficiently

Wholesale allows for a more reactive approach. You can stock based on demand rather than forecasting months in advance. This reduces the risk of being stuck with unsellable inventory and allows you to adjust quickly if a product isn’t performing well.

Returns are simplified; if the product has an issue, the supplier is contacted for repair or exchange. When importing, a degree of waste should be factored into pricing before manufacturing, as the ability to return to the manufacturer is practically zero.

Additionally, suppliers handle logistics, from manufacturing to the domestic country where the goods will be sold. You don’t have to worry about import taxes, customs clearance, or shipping delays. However, delays remain a concern as they impact your lead times. The supplier may be able to deliver to the customer through direct home delivery (DHD), further saving you the expense of larger warehouse facilities.

Large order quantities, typically associated with importing, mean there’s always a risk of overstocking. If a product doesn’t sell as expected, you could be left with excess stock. Storage costs can also add up, and the original margin sought is eroded. In-stock products, however, are an advantage over other retailers. Having the item ready to go can win the sale.

As of March 2025, the Trump administration announced tariffs on several countries. Tariffs, even if not imposed on your country, can still lead to increased prices for both wholesale and direct imports due to the disruption of traditional supply routes.

The time value of money (TMV) is the idea that money today is worth more than the same amount in the future due to its potential to earn returns. Whether through investment, reinvestment, or business growth, holding onto cash now provides more flexibility and opportunities than waiting for future payments. Inflation, risk, and opportunity cost all play a role, making timing just as important as the amount itself when making financial decisions.

Increasing Margin and Differentiation through Importing

The main drawback of wholesale is the reduced control over pricing and product design. Since you’re buying from an intermediary, costs are higher compared to importing directly, resulting in lower profit margins vs importing. Additionally, your ability to differentiate from competitors may be limited unless the supplier allows for product customisation. If multiple retailers source from the same wholesaler, competition can become more price-driven, making it harder to stand out—effectively turning your product into a commodity.

This is why many businesses choose to import directly. Furniture manufacturing is often based in Asia, where, in certain countries, low wages and government subsidies keep costs down, offering higher margins and product customisation. However, while importing allows you to design products tailored to your customer’s preferences, it introduces another challenge—demand forecasting. How many units should you order? Ten or twenty sideboards? Thirty nests of tables? Many manufacturers have minimum order requirements, typically requiring a minimum of ten units per piece. Misjudging demand can result in excess stock, tying up cash flow and increasing financial risk, as we discussed earlier.

How To Differentiate When Stock Is a Commodity

Importing is out of reach for many businesses, even well-established ones, especially during economic downturns. While importing offers higher margins—allowing for more investment in marketing, innovation, and business growth—it also requires significant upfront capital. When foot traffic is low, having money tied up in stock is a significant risk. Without capital reserves, wholesale is often the safer, more manageable choice.

Differentiation in a Wholesale-Driven Market

If you’re sourcing wholesale products that multiple retailers stock, you need to be noticed—you need to stand out to buyers. When customers can find the same product elsewhere, the deciding factor often shifts to service, support, and overall buying experience. If you don’t provide other reasons for customers to choose you, price becomes the only differentiator, leading to a race to the bottom.

Even in a price-sensitive market, not all customers are purely driven by cost. Some—what we call nomadic buyers—have no brand loyalty and will always chase the lowest price. However, others will choose retailers based on trust, service, and convenience. The goal is to reduce reliance on price competition by offering value beyond the product itself.

Price-sensitive shoppers are often what we call nomadic buyers. They shop around for the best deals without loyalty to any brand or business. Their relationship with the brand ends once the sale concludes, as their primary interest was the discount, not the product or the brand itself. Focusing more on immediate savings than long-term benefits, such as product quality, durability, or after-sales service.

Speed & Convenience

Customers expect a seamless shopping experience, whether they’re buying a budget item or a premium piece. Speed isn’t just about delivery times—it includes how quickly you respond to queries, process orders, and handle issues. A slow checkout process, unclear stock availability, or frustrating returns can push customers to competitors.

Providing real-time tracking, clear delivery windows, and proactive updates can significantly improve customer experience. Convenience also includes hassle-free returns, transparent policies, and well-communicated warranties.

Product Expertise

In a crowded market, expertise can be a major differentiator. Instead of just listing dimensions, provide care guides, styling tips, and real-life usage scenarios. This not only enhances customer trust but also reduces unnecessary pre-sale questions, saving both your time and theirs.

If customers can easily find all the information they need from you, they’re less likely to continue searching—potentially preventing them from discovering a competitor with a lower price.

Value-Added Service (VAS)

A Value-Added Service (VAS) is anything that enhances the customer experience beyond the core product. Some examples:

- Pre-Purchase: Swatch/sample deliveries, customisation options.

- During Purchase: Flexible payment plans, eco-friendly packaging.

- Post-Purchase: Assembly services, extended warranties, care kits, and loyalty perks.

Even in wholesale, margins can be protected if customers see added value. These extras can justify a price premium and create a competitive edge. If you remove the “cost” of anxiety—whether through a generous return policy, transparent stock information, or expert guidance—customers may be willing to pay a slight premium for the reassurance of buying from a retailer they trust.

The story around how your product solves a problem for a customer or enhances their life drastically increases your chances of a sale.

However, differentiation for the sake of being different is a wasted effort if it isn’t backed up by elements such as good service or quality. Simply standing out isn’t enough—differentiation must provide real value. A quirky product or unique feature might grab attention, but if it doesn’t improve the customer experience or solve a real problem, it won’t drive long-term success. True differentiation should be purposeful—giving customers a clear reason to choose you over competitors, not just making you look different.

Are You More Comfortable with Stability or Potential Reward?

Whether wholesale or importing is better for your business often depends on your risk tolerance. This is especially true for smaller businesses, where leadership decisions and attitudes have a direct impact on company culture. If you are stressed due to the pressures of importing, it could negatively impact both your focus and team morale.

Simple Self-Assessment

What’s Your Risk Tolerance?

This quick, simple self-assessment can help you gauge whether wholesale or importing aligns better with your mindset.

1️. How do you feel about working with international suppliers, navigating customs, and managing shipping logistics?

- A) I prefer simplicity—minimising hassle is key.

- B) I can handle it if the benefits outweigh the complexity.

- C) I like having more control, even if it means extra work.

2️. If a shipment was delayed by a few weeks or a month, how would your business cope?

- A) It would severely impact my ability to sell and generate revenue.

- B) It would be inconvenient, but I could manage.

- C) I plan for such risks and would have backup stock.

3️. When making business decisions, what matters most to you?

- A) Stability and predictable costs.

- B) A balance between stability and opportunity.

- C) Maximising profit and long-term control.

Mostly A’s: You prioritise stability, making wholesale a natural fit.

Mostly B’s: A hybrid approach—using both wholesale and importing—could offer the best balance.

Mostly C’s: You’re comfortable navigating uncertainty for higher margins, making importing a strong option.

The Real Question: What’s Your Long-Term Strategy?

Sourcing isn’t just about margins or control—it’s about ensuring your business remains resilient. Instead of focusing on perceived control, the focus should be on choosing a strategy that can adapt to challenges without putting your business at risk.

In fact, both wholesale and importing can be combined to leverage the benefits of each, creating a strategy that balances short-term stability with long-term growth. For instance, using wholesale for core products ensures a reliable revenue stream, while importing unique, high-margin items can provide opportunities for differentiation and increased profit margins.

Consider The Illusion of Control

Many retailers assume that importing gives them more independence, allowing them to choose manufacturers and set their own pricing. While this is partly true, real-world challenges like customs delays, fluctuating shipping costs, and quality control issues can erode those perceived advantages.

The illusion of control is the tendency to overestimate our ability to influence outcomes, even when external factors play a major role (Langer, 1975). If your strategy assumes everything will run smoothly, even one disruption could throw your business off course.

This doesn’t mean importing is the wrong choice, but it highlights the need for contingency planning. If you opt for importing, make sure your business has the flexibility to absorb potential setbacks.

Our weekly newsletter provides digestible content on business strategy, marketing tactics and behavioural economics designed to fuel your furniture business.

Manufacturing Closer to Home: UK and European Manufacturers

While many businesses turn to Asian manufacturers for lower costs, manufacturing products in the UK or Europe presents different advantages and trade-offs.

Manufacturing closer to home often comes with higher upfront costs, but the benefits—such as improved logistics, quality assurance, and ethical sourcing—may justify the expense. Businesses prioritising premium positioning, sustainability, or faster turnaround times may find UK and European manufacturers a strong alternative.

One of the most significant advantages is the shorter supply chain, which can reduce transportation costs and ensure quicker replenishment cycles. Faster lead times can improve cash flow and reduce the risk of overstocking or running out of popular products. UK and European manufacturers also often operate under stricter labour regulations, ensuring better working conditions and fair wages. Ethical sourcing can be a key selling point for customers who value responsible business practices, making it easier to justify higher prices and foster brand loyalty.

Of course, not all manufacturing in Asia is about low cost and quality—far from it. High-quality craftsmanship thrives in many regions, and Japan is a prime example. I’m looking at you, Olfa, Makita, Mitutoyo, Gyokucho, and Fujikawa.

Sustainability is also an increasingly important factor, with many consumers actively seeking brands that minimise their carbon footprint. By sourcing locally, businesses can promote reduced transport emissions and capitalise on “Made in the UK” or “Made in Europe” branding to reinforce their commitment to quality and sustainability.

It’s important to note that even if you choose to manufacture in the UK, some level of importation is inevitable. Very few products can be made entirely from domestically sourced materials and components. So, if your stance on UK manufacturing is driven by protectionism, it’s a non-starter—importation has to happen at some point in the production process.

Ultimately, choosing to source from UK or European manufacturers is about balancing cost, quality, ethics, and brand positioning.

Following the initiation of trade wars, the softened support for Ukraine and the general protectionism initiated by the United States during President Trump’s second term have led to a “Buy EU” movement gaining momentum. Whether it will become more prominent than it is, only time will tell, but it could become a significant selling point.

James Rickards - Sold Out

In his discussion on decoupling from China and disinflation, James Rickards, in Sold Out, argues that high-value manufacturing—though more costly—can drive productivity gains, which ultimately reduce inflationary pressures. In other words, while cheap labour in low-value manufacturing regions may offer short-term cost savings, investing in higher-cost, high-value local production can be more efficient in the long run.

This operational efficiency arises from improved capacity utilisation, the learning curve, and expertise within a skilled workforce. By producing more goods with greater precision and fewer defects, businesses can lower the costs associated with repairs and servicing. The result is a more efficient operation, where savings from reduced defects and enhanced processes enable businesses to absorb additional costs, such as wage increases, without harming profitability.

Although wage increases represent an added cost, they can be seen as an investment in the workforce. Retaining skilled employees reduces the need for costly hiring and training processes, ultimately leading to long-term savings. This trade-off between wage increases and reduced turnover costs enables businesses to maintain a stable and efficient operation.

Sourcing Environmental Considerations

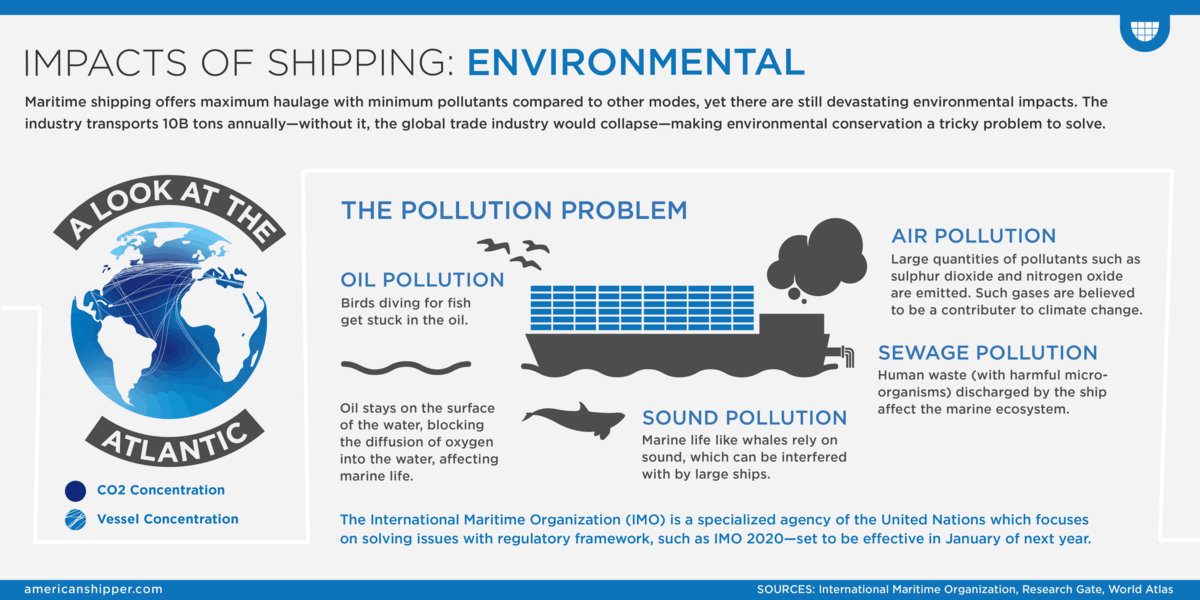

Under a business-as-usual scenario, and if other sectors of the economy reduce emissions to keep the global temperature increase below 2 degrees, shipping could represent some 10% of global GHG emissions by 2050. Ships use some of the world’s dirtiest fuels on earth. – T&E

The carbon footprint and emissions of manufacturing were briefly touched upon above, and although it may not be a consideration for you, it may be for your audience, so it should be for you as well.

“Compared with planes and trucks, Ships are the greenest form of mass transport. Shipping contributes 11 grams of CO2 per ton per mile, a tenth of what trucks produce. Air freight flies way ahead, emitting 1193 grams per ton-mile. Sending a container from Shanghai to Le Havre emits fewer greenhouse gases than the truck that takes the container to Lyon. The Natural Resources Defence Council calculated the emissions involved in the journey of a typical T-shirt from a Chinese factory to an American back. This imaginary TEU was packed with 16 tons of cotton in Urumqi, Xinjiang, and sent to Denver, Colorado. If it went by truck to Shanghai, by air to Los Angeles and by truck again to Denver, its emissions were 35 times more than the same journey using rail and sea. On the ocean leg only, a retailer could save 99 tons of emissions by sending the cotton by ship and not plane.

The International Maritime Organization (IMO) calls maritime transport a ‘relatively small contributor to atmospheric emissions’. It would be, if the industry weren’t so successful. Shipping is not benign because there is so much of it. It emits a billion tons of carbon a year and is responsible for nearly four per cent of greenhouse gases (although rival sides have different figures). That is more than aviation and road transport. A giant ship can emit as much pollution into the atmosphere as a coal-fired power station. Add shipping to the list of polluting countries and it comes sixth. Ships create more pollution than Germany. And yet for decades nobody noticed.” – Deep Sea and Foreign Going, Rose George, Pg98.

Infographic: American Shipper, Shipping Impact Series: Environmental, Emily Ricks

Meaning that while some industry experts, those probably with a stake in shipping not falling, may say shipping is the most environmentally friendly mode of transport, the reality is more complex. On a per-unit basis, container ships produce significantly lower emissions than trucks or planes. However, the sheer scale of global shipping means that its overall carbon footprint is enormous—more than that of road transport or aviation. A single large cargo ship can emit as much pollution as a coal-fired power station, and if shipping were considered a country, it would rank among the world’s top polluters.

This raises an important point when considering the environmental impact of manufacturing locations. Many products sold in the UK are manufactured in China, which is the world’s largest polluter. While shipping a product from China may be more efficient than transporting it over long distances by truck, the emissions from production still need to be taken into account. In contrast, manufacturing in the UK or Europe can often have a lower total carbon footprint, especially if powered by cleaner energy sources.

From a marketing perspective, consumers often perceive locally made products as higher quality and more environmentally friendly. If a product is manufactured in Europe and shipped within the region rather than imported from China, businesses can highlight both quality and sustainability as key selling points. While logistics play a role in emissions, the true environmental impact comes from the entire supply chain—not just how a product is transported but also where and how it is made.

In complete fairness, China is currently the world’s most polluting country. However, it has emitted far less than the United States over the past three centuries. This is largely due to the Industrial Revolution that took place in the U.S. during that period. By the time the East began to emerge as the industrial powerhouse it is today, much had already been ‘learned’ from the Western world. The second-mover advantage suggests that China had access to more advanced technology at the outset of its industrial revolution, giving it a clearer path forward compared to the U.S. at the beginning of its own industrialisation.

Choosing the Right Sourcing Strategy

There is no one-size-fits-all approach to sourcing products—wholesale, importing, and sourcing closer to home each come with their own advantages and trade-offs. The key to making the right choice lies in aligning your sourcing strategy with your business goals, operational capacity, market positioning, and what your customers prioritise.

- Wholesale offers flexibility and lower upfront risk, making it an ideal option for businesses seeking to test products without a significant financial commitment. However, margins may be slimmer, and suppliers control product availability.

- Importing allows for higher margins and exclusivity, enabling businesses to differentiate through unique product selections. However, it also introduces added complexity in logistics, financial management, and regulatory compliance.

- UK and European manufacturers provide a strong alternative for brands prioritising quality, sustainability, and ethical sourcing. Stricter labour and environmental standards can enhance brand reputation, but this often requires a premium pricing strategy to offset higher production costs.

Profit margin only matters if customers are coming through the door. If there are no customers to buy higher-margin products, there is no benefit. While larger margins can enable reinvestment, consider whether tying up cash in inventory is the best move right now. Would that money be better spent on marketing efforts to drive traffic and sales in the short term? Additionally, focusing solely on margin without considering the customer journey risks missing the bigger picture—elements your customers may actually value.

Personal Thoughts

Importing is often essential—no country can produce everything it needs, and most industries rely on global supply chains. However, importing shouldn’t be seen as the sole answer to improving your competitive margin.

A low-cost, low-price approach on its own is inherently unstable. There will always be a competitor willing to undercut you. As Porter points out, there is only one true low-cost leader—achieved not simply through pricing but through efficiencies that competitors can’t match.

The better approach is to innovate and carve out a unique position, enabling real market evolution where businesses that deliver true value rise to the top.

In some cases, relying heavily on low-cost imports can give some businesses an artificial advantage—especially those that haven’t innovated or differentiated from competitors. When market conditions shift or are rocked, these businesses—built on price rather than value—are often the most vulnerable.

This disrupts the natural process of creative destruction. Instead of businesses evolving through innovation, they are locked in a cycle of competing with the next lowest-cost producer, hoping to outlast them.

However, if businesses decided to innovate and approach the market differently, true “natural selection” through creative destruction could occur, allowing businesses that provide real value and differentiation to thrive.

The key is finding a balance. By stepping away from price wars—the “red ocean” of competition—you can define your own market segment. This shift away from chasing the mass market offers a far stronger foundation for long-term success.

Ultimately, the best strategy is one that balances cost considerations with the value you bring to your customers, carving out a space where you’re not just another player.